how to file back taxes without records canada

Here are some of the most common methods used in forensic accounting to file back taxes with no records. How Long Should I.

Tax Responsibilities For International Students And Scholars The Office Of International Affairs The University Of Chicago

Read customer reviews best sellers.

. CANADA WIDE TAX HELP LINE. Ad Get Back Taxes Help in 3 Steps. Ad We Help Taxpayers Get Relief From IRS Back Taxes.

Determine whether you need to contact a tax preparer or you can handle the back taxes on. Read the article to learn how to file back taxes without records. You can request information as far back as the past 10.

The IRS was perfectly comfortable with the newly filed returns and it ended up being a simple. The IRS Statute of Limitations allows you three years from the filing deadline to file your prior year return and claim your. Ad We Help Taxpayers Get Relief From IRS Back Taxes.

We Can Help Suspend Collections Liens Levies Wage Garnishments. The IRS maintains a. How Long To Keep Tax Records Business Documents Blue Pencil.

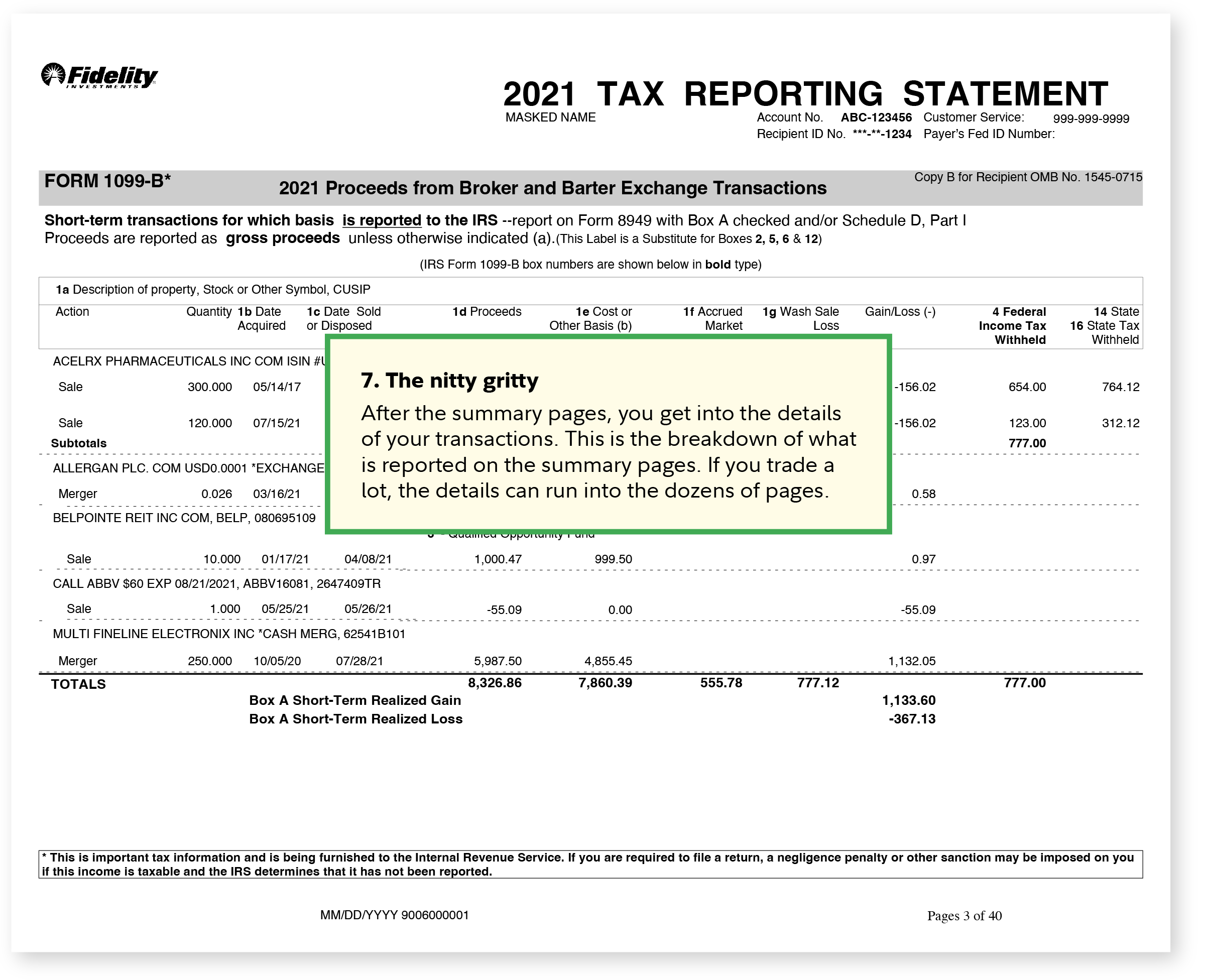

Filing back tax returns could help you do one or more of the following. If you are missing records to correctly file your back taxes the transcript you want is the Wage and Income Transcript. Tax accounting software is popular in small businesses and appears to be sufficient for personal income tax filing.

This an affordable option to hiring a tax accountant. How to File Back Taxes in Canada TaxWatch Canada LLP. Based On Circumstances You May Already Qualify For Tax Relief.

We Can Help Suspend Collections Liens Levies Wage Garnishments. Steps to Filing Previous Years Tax Returns in Canada Do your Research. If you havent filed in years and the CRA has not yet contacted you about your late taxes apply to the Voluntary Disclosure Program as soon as possible.

Simply fill out the form and submit it online. Ad Browse discover thousands of unique brands. Ad Well Search Thousands Of Professionals To Find the One For Your Desired Need.

To file your taxes enter your information through the automated phone line. Using all this information Patricia was able to successfully file all of Jakes delinquent returns. How to file back taxes without records canada Thursday September 1 2022 Edit.

Youll need to have handy your Social Security number or individual taxpayer. One practical reason to file a back tax return is to see if the IRS owes you a tax. Get our online tax forms and instructions to file your past due return or order them by calling 800-TAX-FORM 800-829-3676 or 800-829-4059 for TTYTDD.

Access the EFILE web service to transmit your clients returns directly from your tax preparation software. If you want to find out the status of your past-due tax return you can call the IRS at 800-829-1040. The penalty for filing taxes late is 5 of the tax years balance owing plus 1 of the balance owing for each full month your return is late up to a maximum of 12 months.

Based On Circumstances You May Already Qualify For Tax Relief. Landlord Rental Income And Expenses Tracking Spreadsheet 5 110 Properties Being A. This helps you avoid prosecution for.

Request tax transcripts from the IRS. You can still save yourself from IRS penalties if you have missing or incomplete tax records. If you have not filed your tax return and you are entitled to a refund did you know that the deadline for you to claim the refund is 3 years from its due date including extensions.

Alternatively you can ask your tax preparer to change your return using the EFILE certified software they use. How Many Years Back Can You Get A Tax Refund. Use an EFILE certified tax calculation software package.

Automated phone line File my Return CRA will send an invitation letter to eligible people. Ad Get Back Taxes Help in 3 Steps. How to file back taxes without records canada Wednesday June 15 2022 Edit.

Can I File An Income Tax Return If I Don T Have Any Income Turbotax Tax Tips Videos

How To File A Late Tax Return In Canada

Publication 17 2021 Your Federal Income Tax Internal Revenue Service

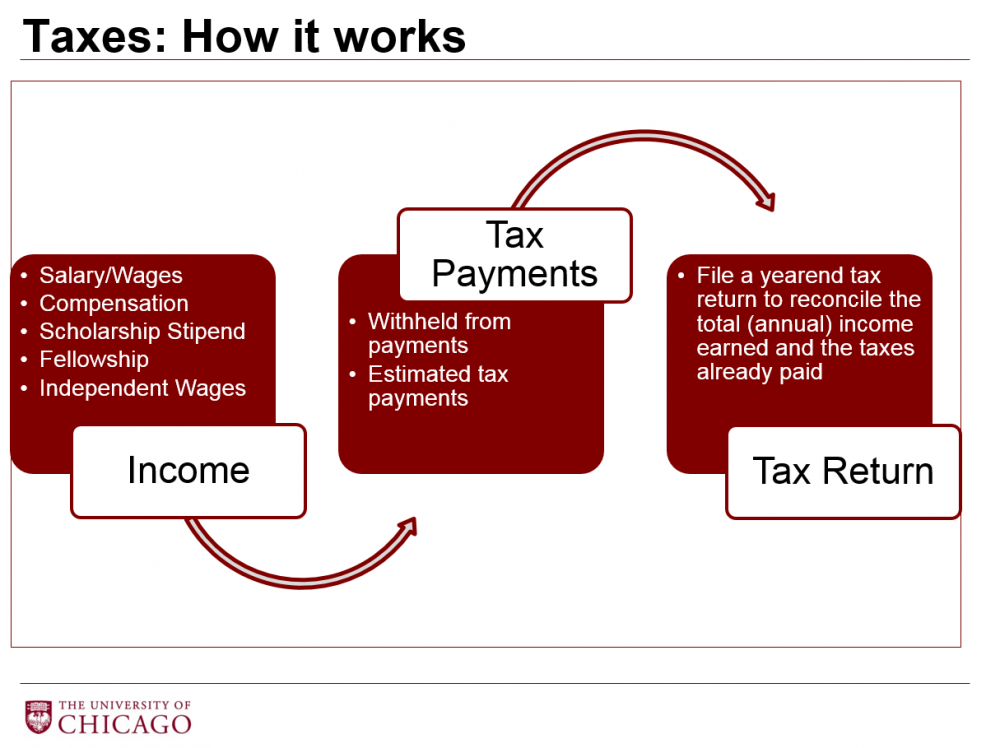

Taxes 101 Understanding The Essentials

Best Free Tax Software 2022 Free Online Tax Filing Zdnet

Unfiled Taxes What If You Haven T Filed Taxes For Years Kalfa Law

T5013 A Simple Guide To Canadian Partnership Tax Forms Bench Accounting

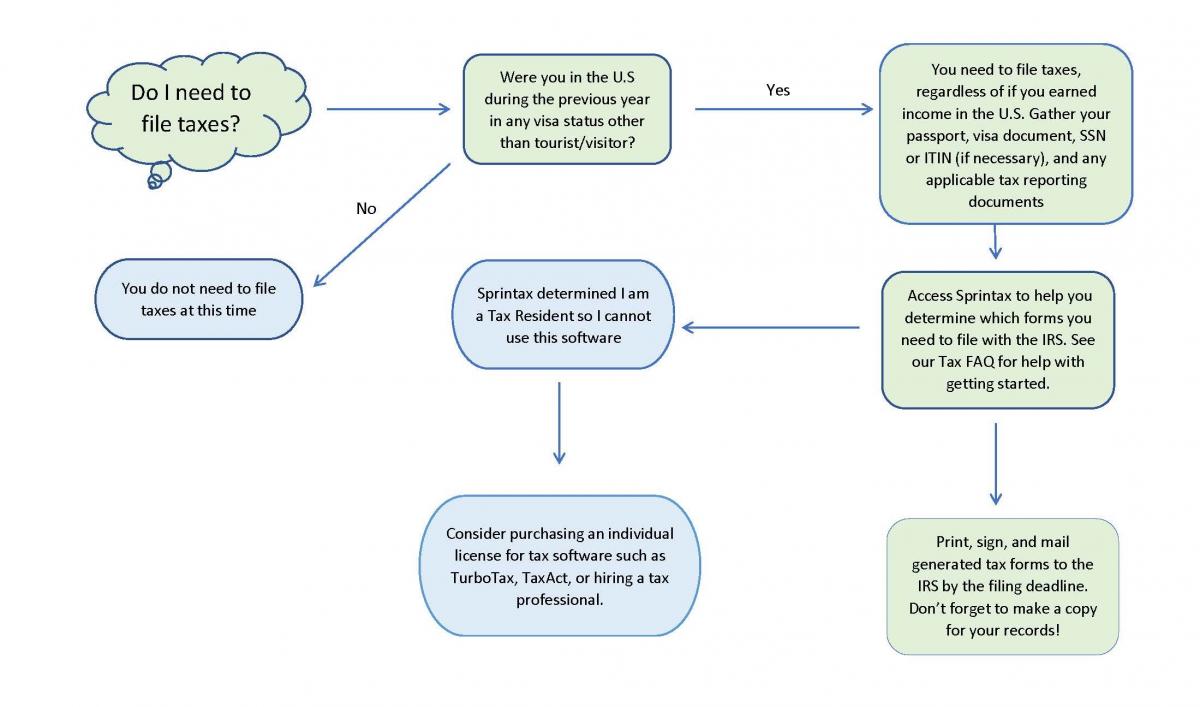

Faq For Tax Filing Harvard International Office

Catch Up With Unified Taxes In Canada Canadiantaxamnesty

Consequences Of Filing A Late Income Tax Return Canadian Budget Binder

What You Need To Know This Tax Season And How To Plan For The Next One Cbc News

Tax Deductions For Home Purchase H R Block

A Guide To Filing Your Back Taxes Tax Relief Center

How To File A Late Tax Return In Canada

The Best Online Tax Filing Software For 2022 Reviews By Wirecutter

File Late Tax Returns Taxwatch Canada Llp

When Are Taxes Due In 2022 Forbes Advisor

How Long To Keep Tax Records Plus How To Organize Old Tax Returns In Your Home Filing System